On a quiet spring morning, Clara Whitmore, the CEO of Union Crest Bank, walked into the institution’s main branch. Known for her strict attitude and emphasis on appearance, she took pride in being the youngest woman to lead the bank. In her view, professionally dressed clients signaled importance, while anyone outside that image represented potential risk.

That day, an older Black man, Mr. Harold Jenkins, entered the branch. His clothing was simple — a worn jacket and shoes — though he carried himself with composure. Approaching the counter, he politely presented his identification and a small notebook. He asked to withdraw fifty thousand dollars from his account.

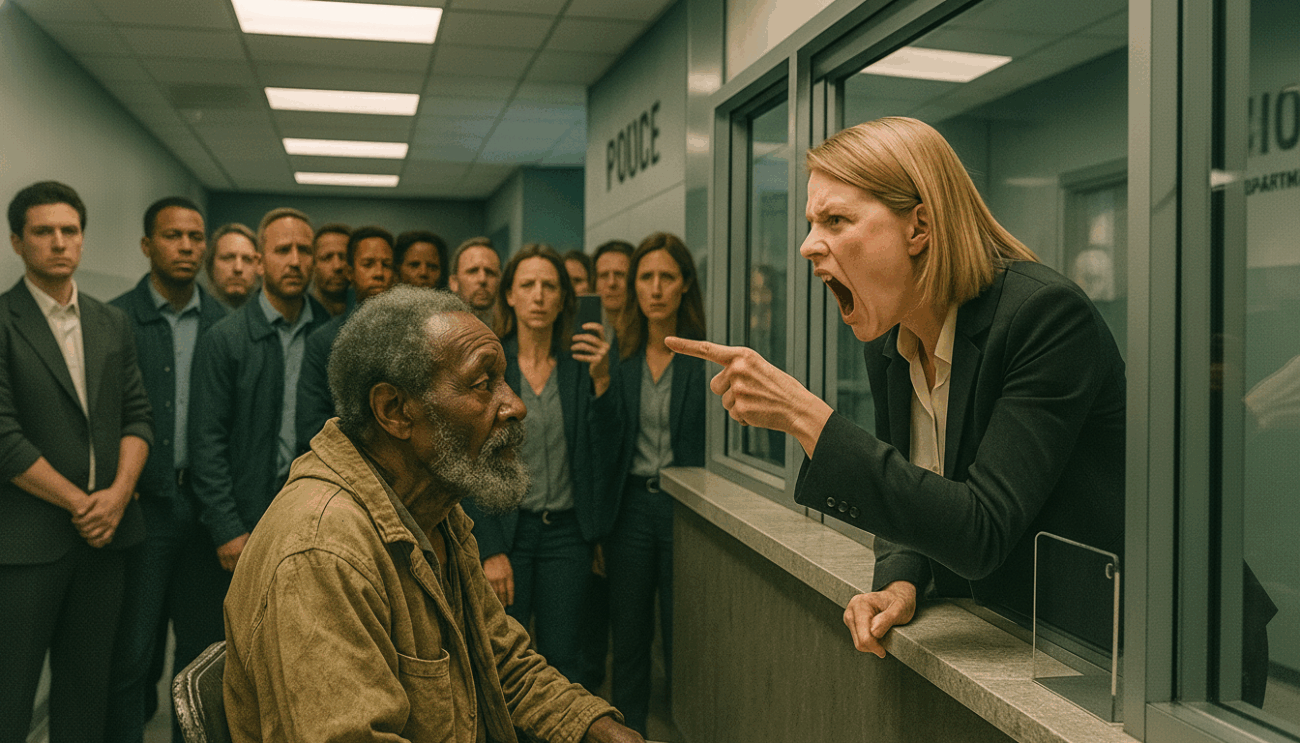

The teller hesitated at the unusually large request, and Clara, who happened to be nearby, stopped to intervene. She informed him that the branch handled private banking and questioned whether he might be in the wrong place. When he insisted that his funds were held there, she raised concerns about recent fraud incidents and suggested he visit another location or return with additional documents. Clara stated that the bank did not release substantial sums to walk-in clients without extensive verification.

The atmosphere in the lobby grew tense. Mr. Jenkins offered to retrieve more documentation from his car. When he returned, Clara was waiting with two security officers and asked him to leave, explaining that the bank could not allow what she considered suspicious behavior. He replied only that she was making a mistake before departing.

Clara regarded the situation as a correctly handled precaution and told her staff that such actions protected the bank. She was unaware that the interaction would shortly have severe consequences.

⸻

A Critical Meeting Turns Into a Career-Ending Moment

By midday, Clara was preparing for the most important negotiation of her tenure — a $3 billion investment partnership with Jenkins Holdings, an influential international financial company. Its CEO, Harold Jenkins Sr., was scheduled to arrive for the final approval and signing of the agreement.

Having spent months arranging the deal, Clara anticipated that the partnership would significantly expand Union Crest’s global presence. The bank’s board, as well as investors, were closely following the development.

When her assistant announced the arrival of Mr. Jenkins, Clara prepared to welcome him. The office door opened, revealing the same man she had escorted out of the branch earlier that morning.

Mr. Jenkins greeted her calmly, noting that they had already met. Clara, visibly shocked, attempted to explain, but he continued by stating that his earlier visit had been a deliberate attempt to observe how the bank treated ordinary customers. He produced the small notebook he had carried, containing detailed notes from their interaction. Jenkins explained that his company invested not only in financial performance but also in integrity and respect — qualities he said he had not witnessed during his visit.

Clara insisted it had been a misunderstanding, but Mr. Jenkins replied that the real misunderstanding had been assuming the bank was a suitable partner. He ended the meeting, informing her he would take his company’s $3 billion investment elsewhere.

Within minutes of his departure, Clara received urgent calls from the board. The agreement had collapsed, and by late afternoon, news of the failed partnership had reached the financial press, triggering a decline in Union Crest’s stock value.

⸻

Consequences and Reflection

As evening fell, Clara remained alone in her office while messages from the board, reporters and investors continued to pour in. Her earlier confidence had been replaced by uncertainty. On her desk lay the business card Mr. Jenkins had left, identifying him as the Founder and CEO of Jenkins Holdings, along with a handwritten note: “Respect costs nothing but means everything.”

In the weeks that followed, Clara’s professional standing deteriorated. The board demanded her resignation, citing a failure in ethical leadership. Union Crest lost key clients, and Clara became widely referenced as an example of how a single decision could undermine an institution’s reputation.

During the same period, Harold Jenkins donated $500,000 to a community fund dedicated to financial literacy programs for disadvantaged youth — a group often underserved by traditional banking services. When asked about the incident, he commented only that dignity should never depend on a customer’s financial status.

Months later, Clara began volunteering at a local financial education center. She did not disclose her former role, saying only that she had worked in the banking sector. She assisted seniors with paperwork, taught basic financial skills and listened to personal stories. In this environment, she felt a renewed sense of purpose.

One day, she overheard a woman recount a story about a wealthy older man who had taught a banker an important lesson. Clara did not identify herself; she simply continued her work, aware that some lessons were best left unspoken.

Meanwhile, in his office elsewhere in the city, Harold Jenkins reflected on the events, convinced that meaningful change was more powerful than public reprimand.